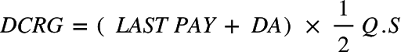

ഡിസിആര്ജി എന്നാല്

അവസാനത്തെ ശമ്പളത്തോട് ഡിഎ കൂട്ടുക.

എന്നിട്ട് അതിനെ,

ആകെ യുള്ള സര്വ്വീസിന്റെ പകുതി കൊണ്ട് ഗുണിക്കുക

An officer drawing a pay of Rs. 68,700 with effect from 1.04.18. His date of retirement is on 31.03.19 after completing 32 years of service. What is the amount of DCRG he is eligible for? The DA as on 31.03.19 is 20%A:-1030500B:-1319040C:-1099200D:-1236600Correct Answer:- Option-B

Rounding is not applicable in the calculation of:

What will be the DCRG of an officer based on the following partic ulars. Date of birth 1.5.1960; Date of entry into service 1.9.1981. The officer was drawing pay at Rs. 95,000 w.e.f. 1.4.2015 in the scale of Rs. 89,000-2000-97000- 2200-10800-2400-120000-the DA on their time was @ 9%

ReplyDeleteA:-Rs. 17,44,545

B:-limited to Rs. 9,00,000

C:-limited to Rs. 14,00,000

D:-Rs. 17,44,600

Correct Answer:- Option-C

What is the D.C.R.G. admissible to an officer. Who retired on 31.3.2019, with a qualifying service of 20 years. Last pay Rs.. 1,08,000. DA % 20.

ReplyDeleteA:-Rs. 1,29,600

B:-Rs. 10,80,000

C:-Rs. 6,48,000

D:-Rs. 12,96,000

Correct Answer:- Option-D

A Joint Secretary to Government drawing a pay of Rs. 1,12,800 retired from service on superannuation on 31.12.2018 after 30 years of Qualifying Service. DA w.e.f 1.7.2018 is 20% of pay. Say what is the amount of DCRG admissible to him?

ReplyDeleteA:-Rs. 20,30,400

B:-Rs. 14,00,000

C:-Rs. 16,92,000

D:-Rs. 8,46,000

Correct Answer:- Option-B

An officer drawing a pay of Rs. 77,400 died while in service on 28.12.2018. He had 21 years of qualifying service at the time of his death. What is the amount of DCRG payable? (DA % as on 1.7.2018 = 20% of Pay)

ReplyDeleteA:-Rs. 11,14,560

B:-Rs. 9,75,240

C:-Rs. 14,00,000

D:-Rs. 4,06,350

Correct Answer:- Option-A

Pls explain

DeleteLast pay*12(service death)

DeletePay of an employee as on 1.3.2018 is Rs. 42,500. He retired on superannuation on 31.12.2018 with a qualifying service of 25 years. What will be his DCRG? (DA 15%)

ReplyDeleteA:-Rs. 6,10,940

B:-Rs. 6,10,937

C:-Rs. 6,10,938

D:-None of the above

Correct Answer:- Option- C:-Rs. 6,10,938

610438

Delete4 months and 5 days from 30.9.2018 end on

ReplyDeleteA:-1.2.2019

B:-2.2.2019

C:-31.1.2019

D:-3.2.2019

Correct Answer:- Option-D:-3.2.2019

5.2.2019

ReplyDelete