പെന്ഷന് കാണാന്

1. അവസാനത്തെ 10 മാസത്തെ ശമ്പളം കുട്ടുക.

2. ഇതിനെ 10 കൊണ്ട് ഹരിക്കുക. അപ്പോള് ആവറെജ് ഇമോളുമെന്റ് ലഭിക്കും.

3. ആവറെജ് ഇമോളുമെന്റിന്റെ പകുതിയാണ് ഫുള്പെന്ഷന്. അതായത് 30 വര്ഷത്തെ സര്വ്വീസിന് ഫുള്പെന്ഷന്.

4. വര്ഷത്തിനനുസരിച്ച്, ആവറേജ് ഇമോളുമെന്റിന്റെ പകുതി ഗുണിക്കണം വര്ഷം ഹരിക്കണം 30 എന്ന ക്രിയ ചെയ്താല് ഉത്തരമായി.

| PENSION |

| 30 YEARS | half AE x 30/30 |

| 29 YEARS | half AE x 29/30 |

| 28 YEARS | half AE x 28/30 |

| 27 YEARS | half AE x 27/30 |

| 26 YEARS | half AE x 26/30 |

| 25 YEARS | half AE x 25/30 |

| 24 YEARS | half AE x 24/30 |

| 23 YEARS | half AE x 23/30 |

| 22 YEARS | half AE x 22/30 |

| 21 YEARS | half AE x 21/30 |

| 20 YEARS | half AE x 20/30 |

| 19 YEARS | half AE x 19/30 |

| ..... | ....... |

| |

| 10 YEARS | half AE x 10/30 |

(1) An officer who retired from service has a qualifying service of 25 years and 5 months. If his average emoluments is Rs. 42,950, what would be his monthly pension?

A:-Rs. 17,896

B:-Rs. 17,895

C:-Rs. 21,475

D:-Rs. 18,612

Qualifying Service | 25 years 5 months =25 YEARS |

Average Emoluments | 42950 |

Pension | = (AE ÷ 2 ) x QS/30 |

| = (42950 ÷2) x 25/30 |

| =17895.8333 |

| =17896 |

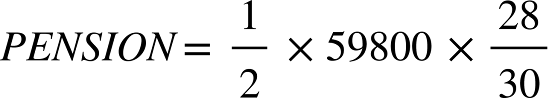

(2) An officer retired on superannuation on 31.05.2018. From the following details ascertain the monthly pension payable to him. Last pay drawn Rs. 60,900. Average emoluments Rs. 59,800. Qualifying service - 28 years and 3 months

A:-Rs. 29,900

B:-Rs. 27,906.6

C:-Rs. 27,907

D:-Rs. 27,750

Correct Answer:- C:-Rs. 27,907

Qualifying Service | 28 years 3 months =28 YEARS |

Average Emoluments | 59800 |

Pension | = (AE ÷ 2 ) x QS/30 |

| = (59800 ÷2) x 28/30 |

| =27906.666 |

Answer | =27907 |

3.An overseer is the public works departments retired from the service on attaining the age of 56 on 31.05.19. The qualifying service for pension and DCRG is 28 years. He was drawing a pay of Rs. 48,000 with effect from 01.08.18 and before that his pay was 46,900. What is the amount of pension he is eligible for?

A:-24,000

B:-21,250

C:-22,400

D:-14,400

Correct Answer:- Option-C

| INCREMENT | 01-08-2018 | 48000 |

| RETIREMENT | 31-05-2020 | 48000 |

| LAST 10 MONTHS | October 2018 to May 2019 |

| | |

| 1 | 8/18 | 48000 |

| 2 | 9/18 | 48000 |

| 3 | .10/18 | 48000 |

| 4 | .11/18 | 48000 |

| 5 | .12/18 | 48000 |

| 6 | .1/19 | 48000 |

| 7 | .2/19 | 48000 |

| 8 | .3/19 | 48000 |

| 9 | .4/19 | 48000 |

| 10 | .5/19 | 48000 |

| TOTAL | 480000 |

| AE | 480000/10 | 48000 |

| | |

| QS | | 28 years |

| AE | | 48000 |

| PENSION | | |

| | =24000 X 9333 |

| | 22399.99 |

| | 22400 |

An officer who retired from service has a qualifying service of 25 years and 5 months. If his average emoluments is Rs. 42,950, what would be his monthly pension?

ReplyDeleteA:-Rs. 17,896

B:-Rs. 17,895

C:-Rs. 21,475

D:-Rs. 18,612

Correct Answer:- A:-Rs. 17,896

An Additional Secretary to Government retired on superannuation on 30.4.2019. He has got a total service of 29 years 5 months and 27 days. His Average Emoluments worked out for pension comes to Rs. 99,200. Calculate his monthly pension.

ReplyDeleteA:-Rs. 48,600

B:-Rs. 47,947

C:-Rs. 47,946

D:-Rs. 49,600

Correct Answer:- Option-D

What will be the monthly pension of an officer who retires on 31.07.2016 from Health Services Department who has drawing a Basic Pay of Rs. 36,000 for the last One Year? (His qualifying services is 31 years)

ReplyDeleteA:-18,000

B:-18,600

C:-17,500

D:-36,000

Correct Answer:- Option-A

An officer retired on superannuation on 31.05.2018. From the following details ascertain the monthly pension payable to him. Last pay drawn Rs. 60,900. Average emoluments Rs. 59,800. Qualifying service - 28 years and 3 months

ReplyDeleteA:-Rs. 29,900

B:-Rs. 27,906.6

C:-Rs. 27,907

D:-Rs. 27,750

Correct Answer:- C:-Rs. 27,907

The date of birth of an administrative assistant of Agriculture Dept. is 27.05.1963. In the Agriculture Department, the age of superannuation is 56 years. Find out the date on which the administrative assistant has to superannuate

ReplyDeleteA:-27.05.2019

B:-31.05.2019

C:-31.05.2018

D:-30.04.2019

Correct Answer:- B:-31.05.2019

An officer with a qualifying service of 15 years retired from service on superannuation on 30.4.2019. His average emoluments for pension is Rs. 30,000. What is his monthly pension?

ReplyDeleteA:-Rs. 15,000

B:-Rs. 7,500

C:-Rs. 8,500

D:-None of the above

Correct Answer:- Option-B

This comment has been removed by the author.

ReplyDelete